New Year Sale 2026! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

CIPS L5M2 Exam - Topic 1 Question 16 Discussion

Actual exam question for

CIPS's

L5M2 exam

Question #: 16

Topic #: 1

[All L5M2 Questions]

Topic #: 1

Which of the following insurances would provide cover in the eventuality that your supplier's place of business flooded and this affected your deliveries?

Suggested Answer:

A

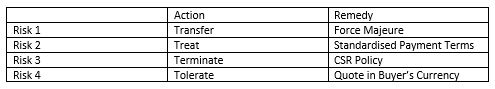

The correct answers are as follows:

CSR= Corporate Social Responsibility

Eun

3 months agoRosenda

3 months agoOwen

4 months agoAlita

4 months agoEvangelina

4 months agoCherelle

4 months agoMaryann

4 months agoLashonda

5 months agoAnika

5 months agoJuan

5 months agoCurt

5 months agoMica

5 months agoMichael

5 months agoSharen

5 months agoDoyle

5 months agoMaryrose

10 months agoJenise

9 months agoGraciela

9 months agoGearldine

9 months agoLeoma

10 months agoBernadine

9 months agoRosita

9 months agoDick

10 months agoMarcelle

10 months agoTesha

10 months agoQueen

10 months agoMary

8 months agoKandis

8 months agoDeeanna

8 months agoStephen

8 months agoNichelle

8 months agoJesus

9 months agoCordell

9 months agoVincent

9 months agoShaquana

10 months agoMarlon

10 months agoPeggie

10 months agoPeggie

10 months agoAlecia

10 months agoMary

10 months agoMicheal

11 months agoJettie

9 months agoAlpha

10 months agoBritt

10 months agoLina

10 months agoTimothy

11 months ago