CFA Institute Exam CFA-Level-II Topic 3 Question 35 Discussion

Topic #: 3

Shirley Nolte, CFA, is a portfolio manager for McHugh Investments. Her portfolio includes 5,000 shares of Pioneer common stock (ticker symbol PNER), which is currently trading at $40 per share. Pioneer is an energy and petrochemical business that operates or markets its products in the United States, Canada, Mexico, and over 100 other countries around the world. Pioneer's core business is the exploration, production, and transportation of crude oil and natural gas. Pioneer also manufactures and markets petroleum products, basic petrochemicals, and a variety of specialty products.

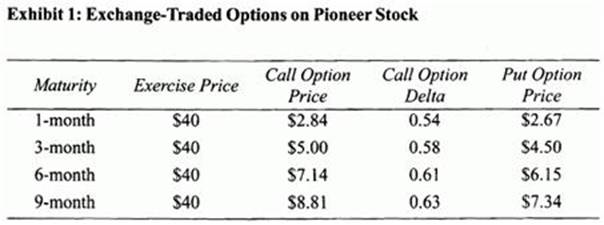

Nolte would like to fully hedge her exposure to price fluctuations in Pioneer common stock over the next 90 days. She determines that the continuously compounded risk-free rate is 5%. She also gathers some information on exchange-traded options available on Pioneer stock. This data is shown in Exhibit 1.

From this data, she determines that the put option deltas are equal to:

* 1 -month put option delta = -0.46.

* 3-month put option delta = -0.36.

* 6-month put option delta - - 0.29.

* 9-month put option delta = -0.17.

She also concludes that the 9-month put option is mispriced relative to the 9-month call option, and an arbitrage opportunity is possible, but that the 3-month put option is correctly priced relative to its comparable call option. She also estimates the gamma of the 3-month call option to be 0.023.

In an unrelated transaction, Nolte is also considering the purchase of a put option on a futures contract with an exercise price of $22. Both the option and the futures contract expire in six months. The call price is $1 and the futures price today is $20.

If Nolte hedges the position with the 3-month call options, she:

The hedge must be continually rebalanced, even in the unlikely event that the stock price doesn't change, because the option's delta changes as time passes and the option approaches maturity. If she simultaneously buys an equivalent amount of put options, the overall position (including the calls, the puts, and 5,000 shares of Pioneer) will no longer be delta hedged. (Study Session 17, LOS 60.e)

Currently there are no comments in this discussion, be the first to comment!