CFA Institute Exam CFA-Level-II Topic 1 Question 67 Discussion

Topic #: 1

Michael Thomas, CFA, is a fixed-income portfolio manager for TFC Investments. As part of his portfolio strategy for the Prosperity Fund, Thomas searches for companies that he expects to be upgraded or downgraded. Those potential upgrades he finds are added to the portfolio or if already in the portfolio are increased in proportion to other holdings before the upgrade takes place. Potential downgrades are sold from the portfolio before the downgrade takes place. Thomas is evaluating his portfolio's current holdings which include several bonds issued by companies in the oil and gas exploration and refining industries. Year-end rating updates are expected to occur in a few days and Thomas is preparing to adjust his portfolio based on expected changes in credit ratings. He has assembled the following annual data on four of the oil and gas stocks in the portfolio:

Exhibit: 1

Thomas has been discussing his fixed-income strategies with a fellow portfolio manager, Shawna Reese. Reese has indicated that while his initial approach is good, the overall credit analysis strategy could be improved and has made the following suggestions to Thomas for both the Prosperity Fund and other fixed-income funds he manages:

* The current methodology does not consider special issues related to high-yield debt which makes up approximately 5% of the Prosperity Fund. Because most high-yield issuers have such a heavy dependence on short-term debt financing, analysis of the firm's debt structure will be extremely important to determine the priority of claims on the firm's assets as well as what source(s) of funds will be used to repay the principal. In addition, the corporate structure of high-yield issuers must be examined to determine the issuer's access to cash flows generated by its subsidiaries. A simple analysis of the parent's financial ratios will not reveal complicated corporate structures and indebtedness of subsidiaries that may restrict the issuer's ability to obtain the cash flows necessary to service its debt.

* The current methodology as applied to the Municipal Opportunities Fund does not include the necessary specialized analysis for municipal securities. Among other items, tax-backed munis must be scrutinized as to the issuer's ability to maintain balanced budgets as well as to ensure that the issue has first priority of claims to revenue from public works projects. Revenue-backed munis require an assessment of the sufficiency of rate covenants to cover expenses and debt servicing of the underlying project as well as the ability for other government entities to access the revenues generated by the enterprise before they are passed on to revenue bondholders.

As part of his portfolio analysis, Thomas also examines yield volatility. Thomas makes the following statements:

Statement 1: Implied yield volatility estimates are based on the assumptions that the option pricing model is correct and that volatility is constant.

Statement 2: Yield volatility has been observed to follow patterns over time that can be modeled and used to forecast future volatility.

He concludes his analysis by comparing the swap rate curve to a government bond yield curve as a benchmark.

Which of Thomas's statements concerning yield volatility are correct?

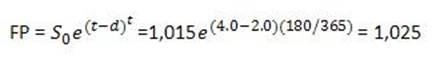

First, calculate the continuously compounded risk-free rate as ln( 1.040811) = 4% and then calculate the theoretically correct futures price as follows:

Then, compare the theoretical price to the observed market price: 1.035 - 1,025 = 10. The futures contract is overpriced. To take advantage of the arbitrage opportunity, the investor should sell the (overpriced) futures contract and buy the underlying asset (the equity index) using borrowed funds. Norris has suggested the opposite. (Study Session 16, LOS 59.f)

King

2 months agoAnnice

29 days agoMacy

30 days agoHermila

30 days agoNikita

1 months agoMozell

1 months agoNikita

1 months agoMarjory

1 months agoSophia

2 months agoReiko

1 months agoLilli

1 months agoZoila

1 months agoDan

3 months agoSon

2 months agoMarci

2 months agoWinifred

2 months agoPamella

3 months agoLorriane

2 months agoJennie

2 months agoAllene

3 months agoKatlyn

3 months agoCorazon

4 months ago