New Year Sale 2026! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AICPA CPA-Regulation Exam - Topic 3 Question 41 Discussion

Actual exam question for

AICPA's

CPA-Regulation exam

Question #: 41

Topic #: 3

[All CPA-Regulation Questions]

Topic #: 3

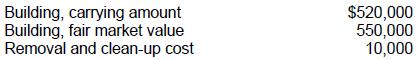

On December 31, 1989, a building owned by Pine Corp. was totally destroyed by fire. The building had fire insurance coverage up to $500,000. Other pertinent information as of December 31, 1989 follows:

During January 1990, before the 1989 financial statements were issued, Pine received insurance proceeds of $500,000. On what amount should Pine base the determination of its loss on involuntary conversion?

Suggested Answer:

B

Choice 'b' is correct. $530,000 basis of involuntary converted building.

Rene

4 months agoBrandon

4 months agoJillian

4 months agoFelicidad

4 months agoIra

5 months agoLaurena

5 months agoBarabara

5 months agoAshley

5 months ago