AICPA CPA-Regulation Exam - Topic 2 Question 42 Discussion

Topic #: 2

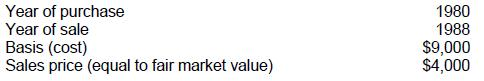

Doris and Lydia are equal partners in the capital and profits of Agee & Nolan, but are otherwise unrelated. The following information pertains to 300 shares of Mast Corp. stock sold by Lydia to Agee & Nolan:

The amount of long-term capital loss that Lydia realized in 1988 on the sale of this stock was:

Choice 'a' is correct. $5,000 long term capital loss 'realized' in 1988 by Lydia. Be careful, and always check the question being asked. In this case, the question is how much of a capital loss Lydia realized in 1988.

Choice 'b' is incorrect. $3,000 represents the portion of the $5,000 realized loss that would currently be recognized unless there were additional capital transactions resulting in gains. Remember that the deduction for capital losses for an individual is limited to $3,000 each year.

Choice 'c' is incorrect. $2,500 represents the pre-1986 portion of the $5,000 realized loss that would have given rise to a recognized loss. Pre-1986 law required $2 of net long term loss to give the benefit of $1 of tax deduction. Current law gives a dollar-for-dollar deduction limited to $3,000 in any year.

Choice 'd' is incorrect. $0 would have been the amount of loss recognized if Lydia owned more than a 50% interest in the partnership. Losses realized on transactions between a partnership and a partner owning more than a 50% interest are not deductible as the parties would be considered related and any realized loss would be disallowed.

Dante

4 months agoVicki

4 months agoMisty

4 months agoAmira

4 months agoLatrice

5 months agoThersa

5 months agoNicolette

5 months ago