Free AAFM CWM_LEVEL_2 Exam Dumps

Here you can find all the free questions related with AAFM Chartered Wealth Manager (CWM) Certification Level II Examination (CWM_LEVEL_2) exam. You can also find on this page links to recently updated premium files with which you can practice for actual AAFM Chartered Wealth Manager (CWM) Certification Level II Examination Exam. These premium versions are provided as CWM_LEVEL_2 exam practice tests, both as desktop software and browser based application, you can use whatever suits your style. Feel free to try the Chartered Wealth Manager (CWM) Certification Level II Examination Exam premium files for free, Good luck with your AAFM Chartered Wealth Manager (CWM) Certification Level II Examination Exam.MultipleChoice

Section A (1 Mark)

A ''Family Office'' segment client has investible assets worth of

OptionsMultipleChoice

Section B (2 Mark)

Which of the following activities is/are a part of ''Building the CRM project foundation phase ''in CRM implementation?

MultipleChoice

Section B (2 Mark)

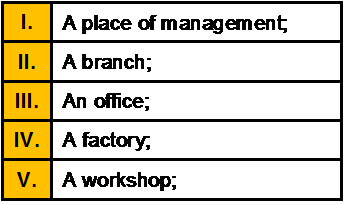

The term ''permanent establishment'' includes especially:

MultipleChoice

Section B (2 Mark)

In a ''Pure Play'' model of wealth management

OptionsMultipleChoice

Section A (1 Mark)

During ''Building the foundation'' life stage, we learn about _______

OptionsMultipleChoice

Section A (1 Mark)

For a ''single income family'' priority is on

OptionsMultipleChoice

Section A (1 Mark)

During ''Teen age years'' life stage, typical asset allocation should be

OptionsMultipleChoice

Section A (1 Mark)

''Accumulation'' is the age between ________

OptionsMultipleChoice

Section B (2 Mark)

If an investor determines that next year's earnings estimate is Rs2.00 per share and the company subsequently falters, the investor may not readjust the Rs2.00 figure enough to reflect the change because he or she is ''anchored'' to the Rs2.00 figure. This is not limited to downside adjustments---the same phenomenon occurs when companies have upside surprises

Which of the following Biases have been exhibited by the investor?

OptionsMultipleChoice

Section A (1 Mark)

During ''Financial Independence'' life stage, typical asset allocation should be

Options